Y Combinator-backed Kapacity.io is on a mission to accelerate the decarbonization of buildings by using AI-generated efficiency savings to encourage electrification of commercial real estate — wooing buildings away from reliance on fossil fuels to power their heating and cooling needs.

It does this by providing incentives to buildings owners/occupiers to shift to clean energy usage through a machine learning-powered software automation layer.

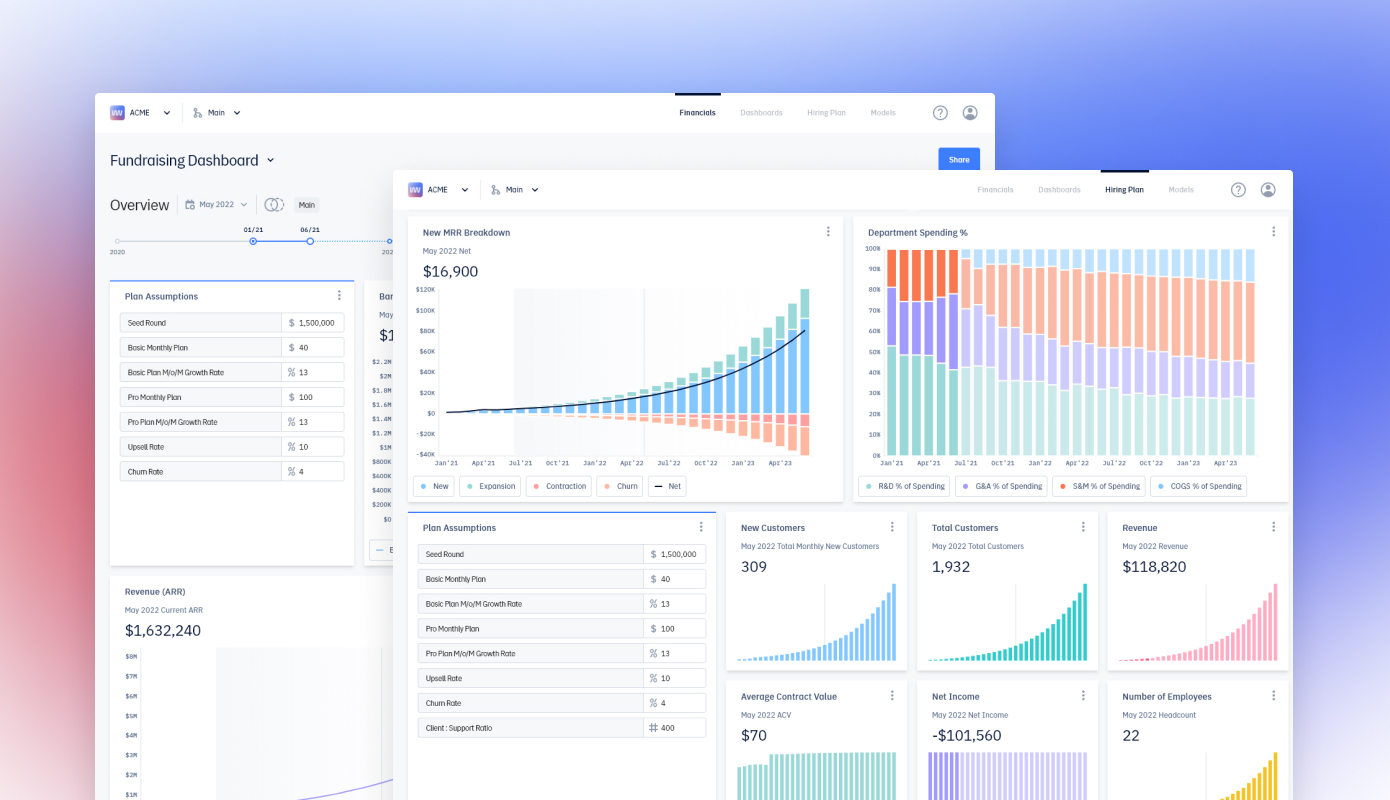

The startup’s cloud software integrates with buildings’ HVAC systems and electricity meters — drawing on local energy consumption data to calculate and deploy real-time adjustments to heating/cooling systems which not only yield energy and (CO2) emissions savings but generate actual revenue for building owners/tenants — paying them to reduce consumption such as at times of peak energy demand on the grid.

“We are controlling electricity consumption in buildings, focusing on heating and cooling devices — using AI machine learning to optimize and find the best ways to consume electricity,” explains CEO and co-founder Jaakko Rauhala, a former consultant in energy technology. “The actual method is known as ‘demand response’. Basically that is a way for electricity consumer to get paid for adjusting their energy consumption, based on a utility company’s demand.

“For example if there is a lot of wind power production and suddenly the wind drops or the weather changes and the utility company is running power grids they need to balance that reduction — and the way to do that is either you can fire up natural gas turbine or you can reduce power consumption… Our product estimates how much can we reduce electricity consumption at any given minute. We are [targeting] heating and cooling devices because they consume a lot of electricity.”

“The way we see this is this is a way we can help our customers electrify their building stocks faster because it makes their investments more lucrative and in addition we can then help them use more renewable electricity because we can shift the use from fossil fuels to other areas. And in that we hope to help push for a more greener power grid,” he adds.

Kapcity’s approach is applicable in deregulated energy markets where third parties are able to play a role offering energy saving services and fluctuations in energy demand are managed by an auction process involving the trading of surplus energy — typically overseen by a transmission system operator — to ensure energy producers have the right power balance to meet customer needs.

Demand for energy can fluctuate regardless of the type of energy production feeding the grid but renewable energy sources tend to increase the volatility of energy markets as production can be less predictable vs legacy energy generation (like nuclear or burning fossil fuels) — wind power, for example, depends on when and how strongly the wind is blowing (which both varies and isn’t perfectly predictable). So as economies around the world dial up efforts to tackle climate change and hit critical carbon emissions reduction targets there’s growing pressure to shift away from from fossil fuels-based power generation toward cleaner, renewable alternatives. And the real estate sector specifically remains a major generator of CO2 so is squarely in the frame for ‘greening’.

Simultaneously, decarbonization and the green shift looks likely to drive demand for smart solutions to help energy grids manage increasing complexity and volatility in the energy supply mix.

“Basically more wind power — and solar, to some extent — correlates with demand for balancing power grids and this is why there is a lot of talk usually about electricity storage when it comes to renewables,” says Rauhala. “Demand response, in the way that we do it, is an alternative for electricity storage units. Basically we’re saying that we already have a lot of electricity consuming devices — and we will have more and more with electrification. We need to adjust their consumption before we invest billions of dollars into other systems.”

“We will need a lot of electricity storage units — but we try to push the overall system efficiency to the maximum by utilising what we already have in the grid,” he adds.

There are of course limits to how much ‘adjustment’ (read: switching off) can be done to a heating or cooling system by even the cleverest AI without building occupants becoming uncomfortable.

But Kapacity’s premise is that small adjustments — say turning off the boilers/coolers for five, 15 or 30 minutes — can go essentially unnoticed by building occupants if done right, allowing the startup to tout a range of efficiency services for its customers; such as a peak-shaving offering which automatically reduces energy usage to avoid peaks in consumption and generate significant energy cost savings.

“Our goal — which is a very ambitious goal — is that the customers and occupants in the buildings wouldn’t notice the adjustments. And that they would fall into the normal range of temperature fluctuations in a building,” says Rauhala.

Kapacity’s algorithms are designed to understand how to make dynamic adjustments to buildings’ heating/cooling without compromising “thermal comfort”, as Rauhala puts it — noting that co-founder (and COO) Sonja Salo, has both a Phd in demand response and researched thermal comfort during a stint as a visiting researcher at UC Berkley — making the area a specialist focus for the engineer-led founding team.

At the same time, the carrots it’s dangling at the commercial real estate to sign up for a little algorithmic HVAC tweaking look substantial: Kapacity says its system has been able to achieve a 25% reduction in electricity costs and a 10% reduction in CO2-emissions in early pilots. Although early tests have been limited to its home market for now.

Its other co-founder, Rami El Geneidy, researched smart algorithms for demand response involving heat pumps for his PhD dissertation — and heat pumps are another key focus for the team’s tech, per Rauhala.

Heat pumps are a low carbon technology that’s fairly commonly used in the Nordics for heating buildings but whose use is starting to spread as countries around the world look for greener alternatives to heat buildings.

In the UK, for example, the government announced a plan last year to install hundreds of thousands of heat pumps per year by 2028 as it seeks to move the country away from widespread use of gas boilers to heat homes. And Rauhala names the UK as one of the startup’s early target markets — along with the European Union and the US where they also envisage plenty of demand for their services.

While the initial focus is the commercial real estate sector, he says they are also interested in residential buildings — noting that from a “tech core point of view we can do any type of building”.

“We have been focusing on larger buildings — multi-family buildings, larger office buildings, certain type of industrial or commercial buildings so we don’t do single family detached homes at the moment,” he goes on, adding: “We have been looking at that and it’s an interesting avenue but our current pilots are in larger buildings.”

The Finnish startup was only founded last year — taking in a pre-seed round of funding from Nordic Makers prior to getting backing from YC — where it will be presenting at the accelerator’s demo day next week. (But Rauhala won’t comment on any additional fund raising plans at this stage.)

He says it’s spun up five pilot projects over the last seven months involving commercial landlords, utilities, real estate developers and engineering companies (all in Finland for now), although — again — full customer details are not yet being disclosed. But Rauhala tells us they expect to move to their first full commercial deals with pilot customers this year.

“The reason why our customers are interested in using our products is that this is a way to make electrification cheaper because they are being paid for adjusting their consumption and that makes their operating cost lower and it makes investments more lucrative if — for example — you need to switch from natural gas boilers to heat pumps so that you can decarbonize your building,” he also tells us. “If you connect the new heat pump running on electricity — if you connect that to our service we can reduce the operating cost and that will make it more lucrative for everybody to electrify their buildings and run their systems.

“We can also then make their electricity consumed more sustainable because we are shifting consumption away from hours with most CO2 emissions on the grid. So we try to avoid the hours when there’s a lot of fossil fuel-based production in the grid and try to divert that into times when we have more renewable electricity.

“So basically the big question we are asking is how do we increase the use of renewables and the way to achieve that is asking when should we consume? Well we should consume electricity when we have more renewable in the grid. And that is the emission reduction method that we are applying here.”

In terms of limitations, Kapacity’s software-focused approach can’t work in every type of building — requiring that real estate customers have some ability to gather energy consumption (and potentially temperature) data from their buildings remotely, such as via IoT devices.

“The typical data that we need is basic information on the heating system — is it running at 100% or 50% or what’s the situation? That gets us pretty far,” says Rauhala. “Then we would like to know indoor temperatures. But that is not mandatory in the sense that we can still do some basic adjustments without that.”

It also of course can’t offer much in the way of savings to buildings that are running 100% on natural gas (or oil) — i.e. with electricity only used for lighting (turning lights off when people are inside buildings obviously wouldn’t fly); there must be some kind of air conditioning, cooling or heat pump systems already installed (or the use of electric hot water boilers).

“An old building that runs on oil or natural gas — that’s a target for decarbonization,” he continues. “That’s a target where you could consider installing heat pumps and that is where we could help some of our customers or potential customers to say ok we need to estimate how much would it cost to install a heat pump system here and that’s where our product can come in and we can say you can reduce the operating cost with demand response. So maybe we should do something together here.”

Rauhala also confirms that Kapacity’s approach does not require invasive levels of building occupant surveillance, telling TechCrunch: “We don’t collect information that is under GDPR [General Data Protection Regulation], I’ll put it that way. We don’t take personal data for this demand response.”

So any guestimates its algorithms are making about building occupants’ tolerance for temperature changes are, therefore, not going to be based on specific individuals — but may, presumably, factor in aggregated information related to specific industry/commercial profiles.

The Helsinki-based startup is not the only one looking at applying AI to drive energy cost and emissions savings in the commercial buildings sector — another we spoke to recently is Düsseldorf-based Dabbel, for example. And plenty more are likely to take an interest in the space as governments start to pump more money into accelerating decarbonization.

Asked about competitive differentiation, Rauhala points to a focus on real-time adjustments and heat pump technologies.

“One of our key things is we’re developing a system so that we can do close to real time control — very very short term control. That is a valuable service to the power grid so we can then quickly adjust,” he says. “And the other one is we are focusing on heat pump technologies to get started — heat pumps here in the Nordics are a very common and extremely good way to decarbonize and understanding how we can combine these to demand response with new heat pumps that is where we see a lot of advantages to our approach.”

“Heat pumps are a bit more technically complex than your basic natural gas boiler so there are certain things that have to be taken it account and that is where we have been focusing our efforts,” he goes on, adding: “We see heat pumps as an excellent way to decarbonize the global building stock and we want to be there and help make that happen.”

Per capita, the Nordics has the most heat pump installations, according to Rauhala — including a lot of ground source heat pump installations which can replace fossil fuel consumption entirely.

“You can run your building with a ground source heat pump system entirely — you don’t need any supporting systems for it. And that is the area where we here in Europe are more far ahead than in the US,” he says on that.

“The UK government is pushing for a lot of heat pump installations and there are incentives in place for people to replace their existing natural gas systems or whatever they have. So that is very interesting from our point of view. The UK also there is a lot of wind power coming online and there have been days when the UK has bee running 100% with renewable electricity which is great. So that actually is a really good thing for us. But then in the longer term in the US — Seattle, for example, has banned the use of fossil fuels in new buildings so I’m very confident that the market in the US will open up more and quickly. There’s a lot of opportunities in that space as well.

“And of course from a cooling perspective air conditioning in general in the US is very wide spread — especially in commercial buildings so that is already an existing opportunity for us.”

“My estimate on how valuable electricity use for heating and cooling is it’s tens of billions of dollars annually in the US and EU,” he adds. “There’s a lot of electricity being used already for this and we expect the market to grow significantly.”

On the business model front, the startup’s cloud software looks set to follow a SaaS model but the plan is also to take a commission of the savings and/or generated income from customers. “We also have the option to provide the service with a fixed fee, which might be easier for some customers, but we expect the majority to be under a commission,” adds Rauhala.

Looking ahead, were the sought for global shift away from fossil fuels to be wildly successful — and all commercial buildings’ gas/oil boilers got replaced with 100% renewable power systems in short order — there would still be a role for Kapacity’s control software to play, generating energy cost savings for its customers, even though our (current) parallel pressing need to shrink carbon emissions would evaporate in this theoretical future.

“We’d be very happy,” says Rauhala. “The way we see emission reductions with demand response now is it’s based on the fact that we do still have fossil fuels power system — so if we were to have a 100% renewable power system then the electricity does nothing to reduce emissions from the electricity consumption because it’s all renewable. So, ironically, in the future we see this as a way to push for a renewable energy system and makes that transition happen even faster. But if we have a 100% renewable system then there’s nothing [in terms of CO2 emissions] we can reduce but that is a great goal to achieve.”