According to one estimate, Americans call 911 about 240 million times every year.

Sending emergency services to the right location sounds straightforward, but each 911 call is routed through one of thousands of call centers known as public safety answering points (PSAPs).

“Every 911 center is very different and they are as diverse and unique as the communities that they serve,” said Karin Marquez, senior director of public safety at RapidSOS.

One PSAP that serves New York City is a 450,000-square-foot, blast-resistant cube set on nine acres, but you also have “agencies in rural America that have one person working 24/7 and they’re there to answer three calls a day,” Marquez noted.

Founded eight years ago, RapidSOS processes more than 150 million emergencies each year across approximately 5,000 PSAPs. The company’s technology helps call centers integrate requests from cell phones, landlines and IoT devices.

“Its technology is almost certainly integrated into the smartphone you’re carrying and many of the devices you have lying around,” Managing Editor Danny Crichton writes in a four-part series that studies the company’s origins and ensuing success:

Full Extra Crunch articles are only available to members

Use discount code ECFriday to save 20% off a one- or two-year subscription

- Part 1: The early years and why a consumer app company turned to govtech and integrated services for technology and device companies.

- Part 2: How RapidSOS made its pivot and why its current business model has performed so well.

- Part 3: To transform 911 services, RapidSOS established dozens of corporate and individual partnerships.

- Part 4: Examines the future of 911 and RapidSOS in light of limited infrastructure funding.

“I’ve honestly never met a company like RapidSOS with so many signed partnerships,” says Danny, who initially wrote about the firm six years ago.

“It’s closed dozens of partnerships and business development deals, and with some of the biggest names in tech. How does it do it? This story is about how it built a successful BD engine.”

Thanks very much for reading Extra Crunch this week!

Walter Thompson

Senior Editor, TechCrunch

@yourprotagonist

How to prepare for M&A, your most likely exit avenue

The headlines might be littered with mega deals, IPOs and SPACs, but in all likelihood, you will exit your startup via a relatively smaller merger or acquisition, Ben Boissevain writes in a guest column.

“The IPO market is healthy again, but M&A still represents 88% of exits: So far this year, there were 503 IPOs and 5,203 deals,” writes Boissevain, founder of Ascento Capital.

“While it is good to strive for a billion-dollar-plus sale, a successful IPO or a SPAC deal, it is practical to prepare your startup for a smaller transaction.”

Duolingo boosts IPO price target in boon to edtech startups

U.S. edtech company Duolingo bumped up its IPO price range Monday morning, targeting $95 to $100 per share, up from previous guidance of $85 to $95 per share.

“The fact that Duolingo is raising its IPO price range indicates that we are more likely on the path for a strong offering than a weak one,” Alex Wilhelm notes.

Data-driven iteration helped China’s Genki Forest become a $6B beverage giant in 5 years

Many Extra Crunch readers will not have heard of China’s fastest-growing bottled beverage company: Genki Forest is a direct-to-consumer startup that started selling its sodas, milk teas and other products just five years ago.

Today, its products are available in 40 countries and the company hopes to generate revenue of $1.2 billion in 2021. After closing its latest funding round, Genki Forest is valued at $6 billion.

Industry watchers frequently compare the upstart to giants like PepsiCo and Coca-Cola, but founder Binsen Tang comes from a tech background, having funded ELEX Technology, a social gaming company that found success internationally.

“China doesn’t need any more good platforms,” Tang told his team in 2015, “but it does need good products.”

Leveraging China’s robust distribution network, lighting-fast manufacturing capabilities and a vast pool of data that enables holistic digitization, Genki Forest sells more than 30% of its products online.

“Everything feels right about the company,” said VC investor Anna Fang. “The space, the founder, the products and the back end … they exemplify the new Chinese consumer brand.“

Sequoia’s Mike Vernal outlines how to design feedback loops in the search for product-market fit

Sequoia’s Mike Vernal joined us on TechCrunch Early Stage: Marketing and Fundraising to discuss how founders should approach product-market fit, with a specific focus on tempo.

It doesn’t mean fast in the kind of uncontrolled, reckless, crashing sense. It means fast in a sort of consistent, maniacal, get-a-little-bit-better-each-day kind of way. And it’s actually one of the top things that we look for, at least when evaluating a team: How consistently fast they move.

As China shakes up regulations, tech companies suffer

Alex Wilhelm spent the end of last week and the beginning of this one looking at Chinese regulations targeting its edtech sector, aiming to understand “precisely what is going on with the various regulatory changes.”

“For startups, the regulatory changes aren’t a death blow; indeed, many Chinese tech startups won’t be affected by what we’ve seen thus far,” he writes. “But on the whole, it feels like the risk profile of doing business in China has risen.”

Automakers have battery anxiety, so they’re taking control of the supply

Image Credits: Porsche AG

To ensure a steady supply of batteries, automakers are increasingly looking to joint ventures.

“Like if you’re VW, and you say, ‘We’re going to go 50% electric by whatever year,’ but then the batteries don’t show up, you’re bankrupt, you’re dead,” Sila Nano CEO Gene Berdichevsky said in a recent interview.

“Their scale is so big that even if their cell partners have promised them to deliver, automakers are scared that they won’t.”

Pro tips from the team behind Kickstarter’s most funded app

Image Credits: AndreyPopov / Getty Images

The team at memoryOS “spent countless hours researching down the rabbit hole of crowdfunding tips and tricks” before it successfully became the most-funded app on Kickstarter, the company’s CEO, Alex Ruzh, writes in a guest column.

“We’re sharing our approach (and secrets) to building a successful crowdfunding campaign because we know just how tough it can be to launch your own product,” he writes.

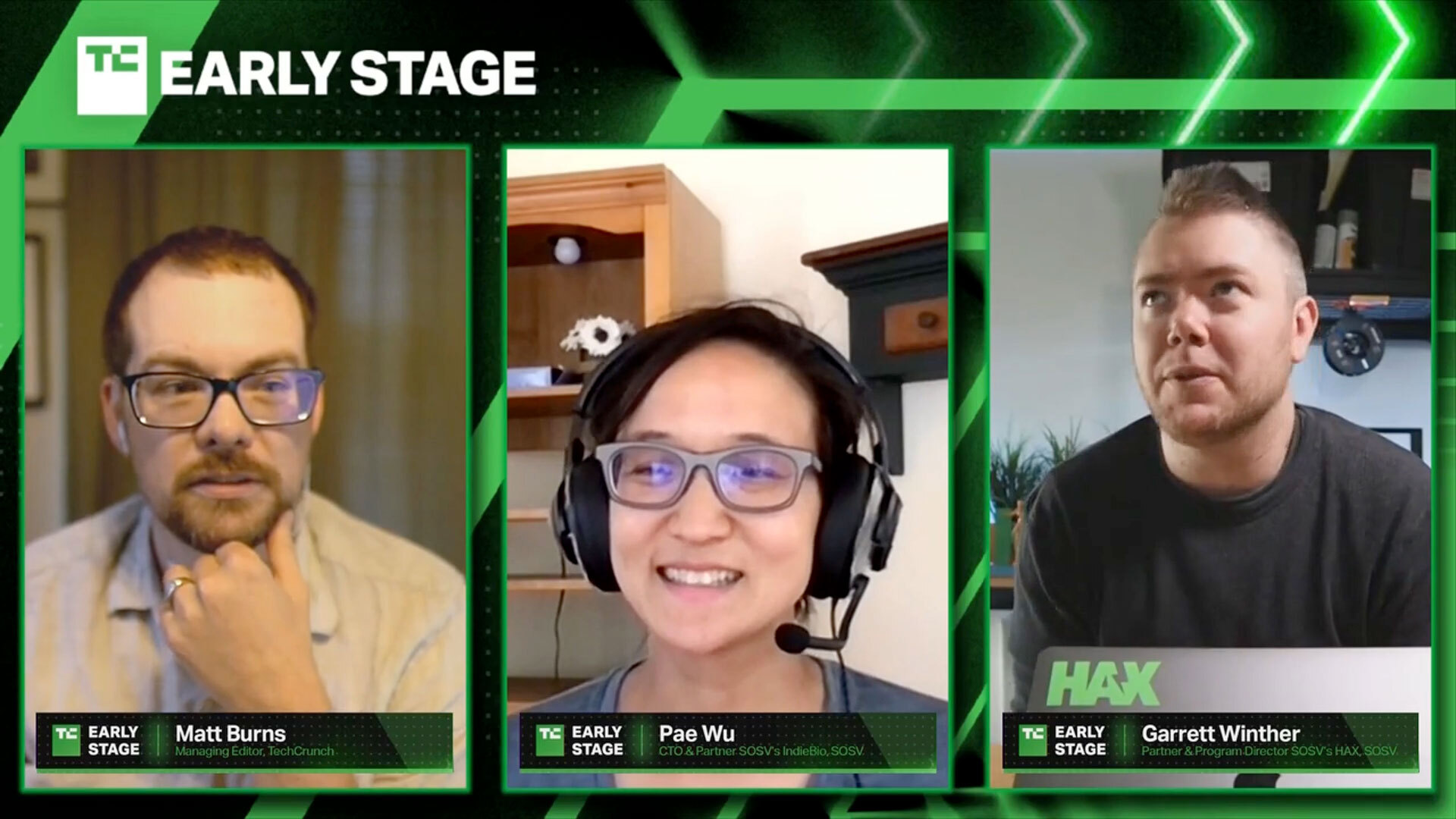

SOSV partners explain how deep tech startups can fundraise successfully

Startups developing so-called deep tech often find it challenging to raise capital for various reasons.

At TechCrunch Early Stage: Marketing and Fundraising, two experienced investors, SOSV partners Pae Wu and Garrett Winther, spoke on the subject and advised startups facing a challenging fundraising path.

Checkout is the key to frictionless B2B e-commerce

Processing payments, credit and authorizations for B2B purchases is all handled electronically, but that’s not a panacea.

For example, volume sellers prefer to work through traditional accounts payable systems instead of paying the service fees smaller companies accept as the cost of doing business.

However, the combination of fraud and identity protection with credit handling and digital payments “creates a powerful network, the type that can not only build trust but enable one-click transactions at scale,” says Andrew Steele, an investor at Activant Capital.

Cowboy Ventures’ Ted Wang: CEO coaching is ‘about having a second set of eyes’

At TechCrunch Early Stage: Marketing and Fundraising, Cowboy Ventures’ Ted Wang spoke about why he encourages founders in his portfolio to work with executive coaches.

I don’t think you need to limit advice from people who are “been there, done that.” I think it is really important to get input from those people, but in terms of personal development, I think you want insight from people who understand how human beings listen and learn and grow.