Quizizz, an Indian startup that is making learning more interactive so that students find it compelling to spend more hours studying, said on Wednesday it has raised $31.5 million in a new financing round.

Tiger Global led the Series B financing round in the five-and-a-half-year-old startup. Yahoo co-founder Jerry Yang and existing investors Eight Roads Ventures, GSV Ventures, Nexus Venture Partners also participated in the new round.

Quizizz, which concluded its previous financing round in March this year, has raised $47 million to-date.

“When we were kids, it was so difficult to focus on studies. Our thesis has been that with kids now living in a world with so much distraction, there’s a need to make learning more interesting,” said Ankit Gupta, co-founder and chief executive of Quizizz, in an interview with TechCrunch.

Along with Deepak Cheenath, Quizizz’s other co-founder, Gupta started the startup’s journey in a non-profit school in Bangalore, where they built several prototypes. The same year — 2015 — the duo engaged closely with teachers and students in the U.S., and pivoted to Quizizz, said Gupta.

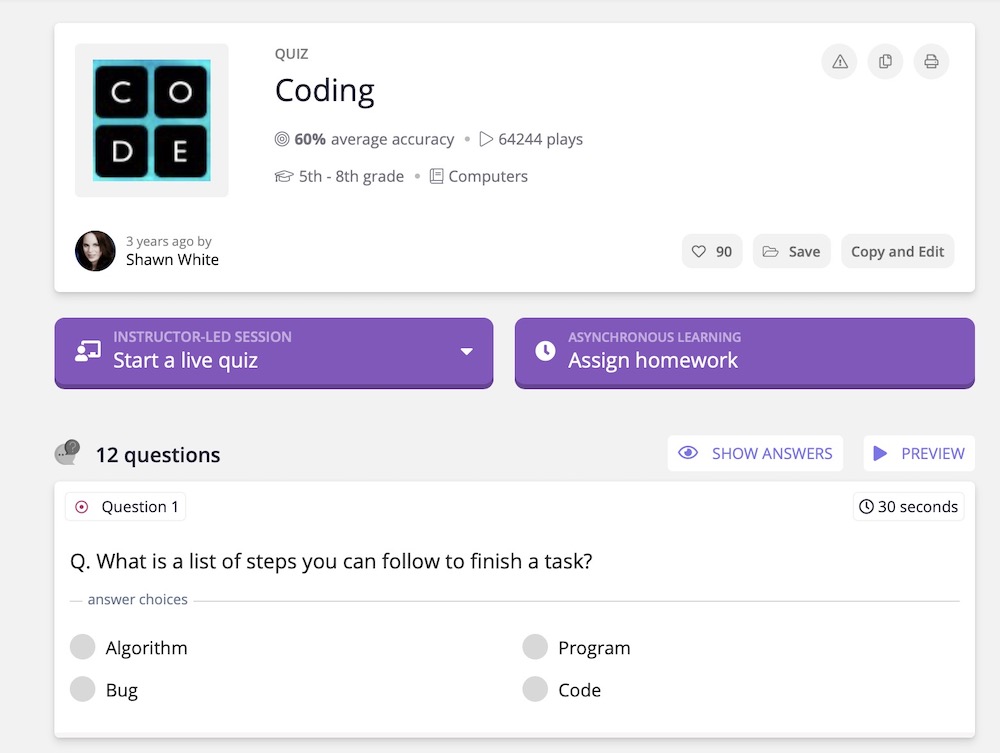

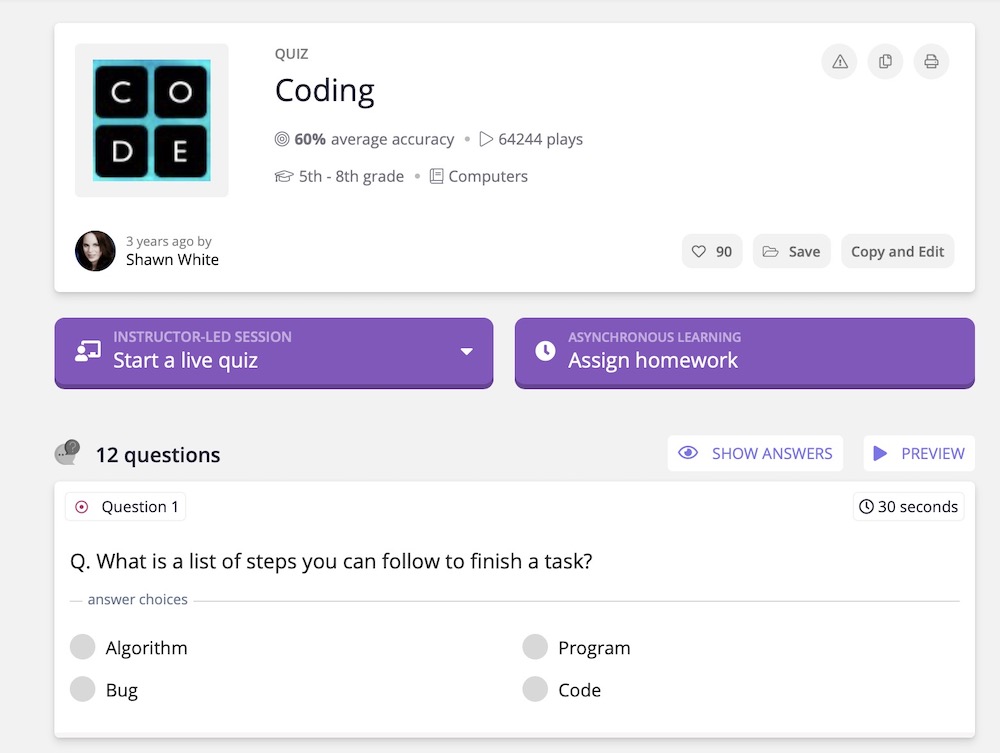

On Quizizz, teachers and the community develop gamified lessons for students. (Teachers don’t have to build these lessons. For the concepts that they want to explain to students, if lessons exist, many just use those instead. The platform has over 20 million quizzes today.)

These lessons have enabled students to find learning more engaging, said Gupta. The platform also enables teachers to identify in real-time students who are struggling with grasping any concept and then to address those gaps, he said.

The platform covers a range of subjects including computer science, english, mathematics, science, social studies, world languages, and creative arts.

Over the years, Quizizz has grown organically across the globe with many classrooms today using the platform, said Gupta. The platform is used by teachers in over 120 nations today with students answering more than 300 million questions on Quizizz each week. In the U.S., which is Quizizz’s largest market now, over 80% of K-12 schools use the platform, he said.

“During the pandemic, Quizziz made the transition to teaching online seamless. Now that we’re back in the building, I’ve used it almost exclusively. Making, finding, and altering lessons using Quizizz has become almost a hobby for me,” said Rory Roberts, a math teacher at Brigantine Community School, in a prepared statement.

“This week, we conducted user-testing with teachers in California, saw a video of students cheering on their classmates in an auditorium in Kenya, and got a thank you note from a group of teachers wearing Quizizz branded t-shirts in Indonesia. We’re incredibly proud of the role our growing team, and teacher community, have played in this movement,” said Quizizz’s Cheenath.

The startup plans to deploy the fresh capital to expand its team across both the U.S. and India to keep up with its growth. It is also looking to form partnerships to accelerate its international expansion.