Cube.js, an open-source company that is building a data platform to help developers by analytical application for both internal and external users, today announced that it has raised a $6.2 million seed round led by Bain Capital Ventures. Previous investors Eniac Ventures, Betaworks, Innovation Endeavors and Slack Fund also participated, in addition to new investors Uncorrelated Ventures and Overtime.vc.

The two co-founders, Artyom Keydunov and Pavel Tiunov, actually built the core of what is now the successful Cube.js project for another company they founded in 2016: Statsbot. Statsbot is a business intelligence platform that helps enterprises create reports and dashboards — and there’s a Slack bot, too.

“While working on Statsbot we build what is Cube.js right now to power the Statsbot application,” Keydunov said. “But over time, as users were using Statsbot, we started to see that they were asking us about how they could use this technology to power internal application or customer-facing applications for analytics. […] We worked with several companies to have some proof of concept of using Cube.js as a standalone technology and we got really positive feedback about that.”

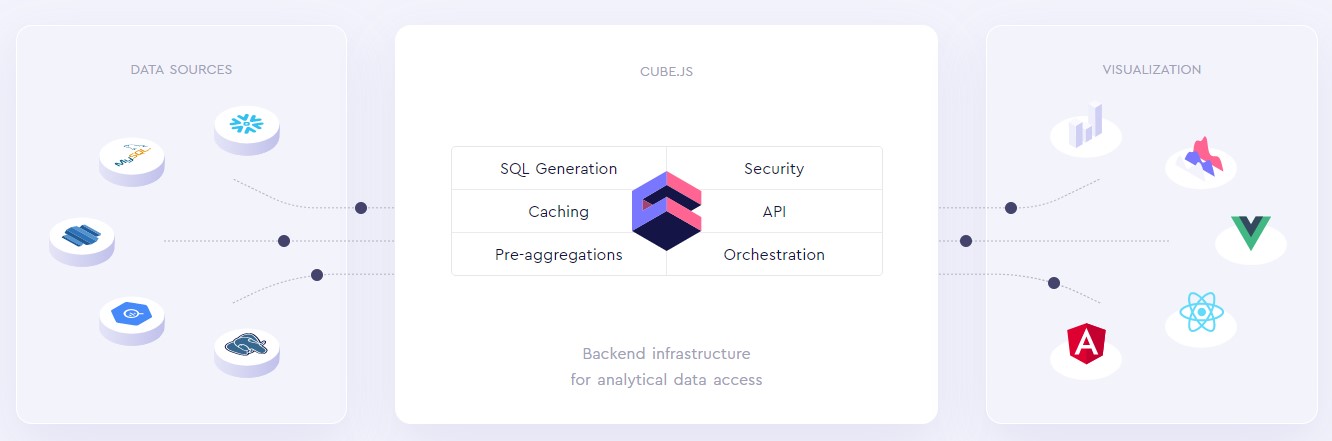

The general idea behind Cube.js is to replace a lot of the busywork of building the backend infrastructure for connecting data sources and building visualizations. The open-source tool is essentially a middleware layer that sites between the databases and the frontend and that handles the SQL generation, caching, security and orchestration so that developers can focus on writing their applications. Thanks to its caching technology, it also solves a lot of performance issues for developers.

As Keydunov argued, if you are a data analyst or data engineer, there are already plenty of tools on the market today that will provide you most of what you need. Developers, though, who typically need to build custom applications, have to rely on a variety of disconnected libraries. “They don’t have any solutions they can use specifically for building analytics applications,” he noted.

“We invest very often in open source companies. And one of the areas of pain points that we’re very well aware of this challenge of building applications that connect to lots of different data sources,” Bain Capital Ventures partner Stefan Cohen told me. “The advent of the public cloud and the heterogeneity of the data sources that are out there and being consumed at such a rapid pace by developers and engineers just makes it really hard to pull all this stuff together in a way that can present visually appealing and useful applications for the enterprise.”

Yet enterprises want these applications because they can help them unlock new revenue and streamline their workflows. That puts Cube.js right in the middle of this trend.

Like most open-source companies, the Cube.js team is looking at offering a commercial cloud and SaaS service for enterprises, with all of the usual enterprise accouterments like additional security and sign-in features.

As Keydunov told me, the team expected to spend 2020 on building out the open-source community around Cube.js through events and meetups. And while that has obviously gotten a bit harder, the team still focused on talking to potential customers and community members as much as possible.

“I think the big challenge — and the opportunity for us — is to make this leap from open source to a commercial product,” Cohen noted. “And it’s great to see so many developers and organizations using the Cube.js open source. But what we really need to do is get that fully featured cloud product available and then start to drive use of it. And not even necessarily monetizing it but just making sure that our enterprise features are the right ones for the market and that we’re solving a meaningful pain point. And I think if we could get that right, the world’s our oyster — but we have to get that product out and then start driving some initial usage.”

Unsurprisingly, that’s also what the team plans to focus on with this new round of funding it now has in the bank.