Google employees take another step in their activism, Venmo adds a check-cashing feature and Slack has some issues. This is your Daily Crunch for January 4, 2021.

The big story: Hundreds of Google and Alphabet employees unionize

More than 200 employees at Google and its parent company Alphabet have announced that they have formed the Alphabet Workers Union.

Obviously, that’s only a tiny fraction of Alphabet’s workforce of more than 130,000 employees. But according to The New York Times, the group is a “minority union” designed to give more structure to employee activism, rather than one that negotiates for a contract. And it will also be open to contractors.

“This is historic—the first union at a major tech company by and for all tech workers,” said Google software engineer Dylan Baker in a statement. “We will elect representatives, we will make decisions democratically, we will pay dues, and we will hire skilled organizers to ensure all workers at Google know they can work with us if they actually want to see their company reflect their values.”

The tech giants

It’s not just you, Slack is struggling this morning — Precisely when the downtime began is not clear, though problems amongst the TechCrunch staff began a little after 10 a.m. Eastern time.

Venmo adds a check-cashing feature, waives fees for stimulus checks — The feature can be used to cash printed, payroll and U.S. government checks, including the new stimulus checks.

Samsung’s next Unpacked event is January 14 — This one’s called “Welcome to the Everyday Epic.”

Startups, funding and venture capital

Color raises $167M funding at $1.5B valuation to expand ‘last mile’ of US health infrastructure — Color’s 2020 was a record year for the company.

Lidar startup Aeva raises another $200M ahead of its debut as a public company — Aeva is one of a handful of lidar companies to eschew the traditional IPO path and go public via a SPAC merger.

India’s CRED raises $81M, buys back shares worth $1.2M from employees — CRED has nearly doubled its customer base to about 5.9 million in the past year, or about 20% of the credit card holder base in India.

Advice and analysis from Extra Crunch

How artificial intelligence will be used in 2021 — Scale AI CEO Alexandr Wang forecasts the biggest emerging use cases.

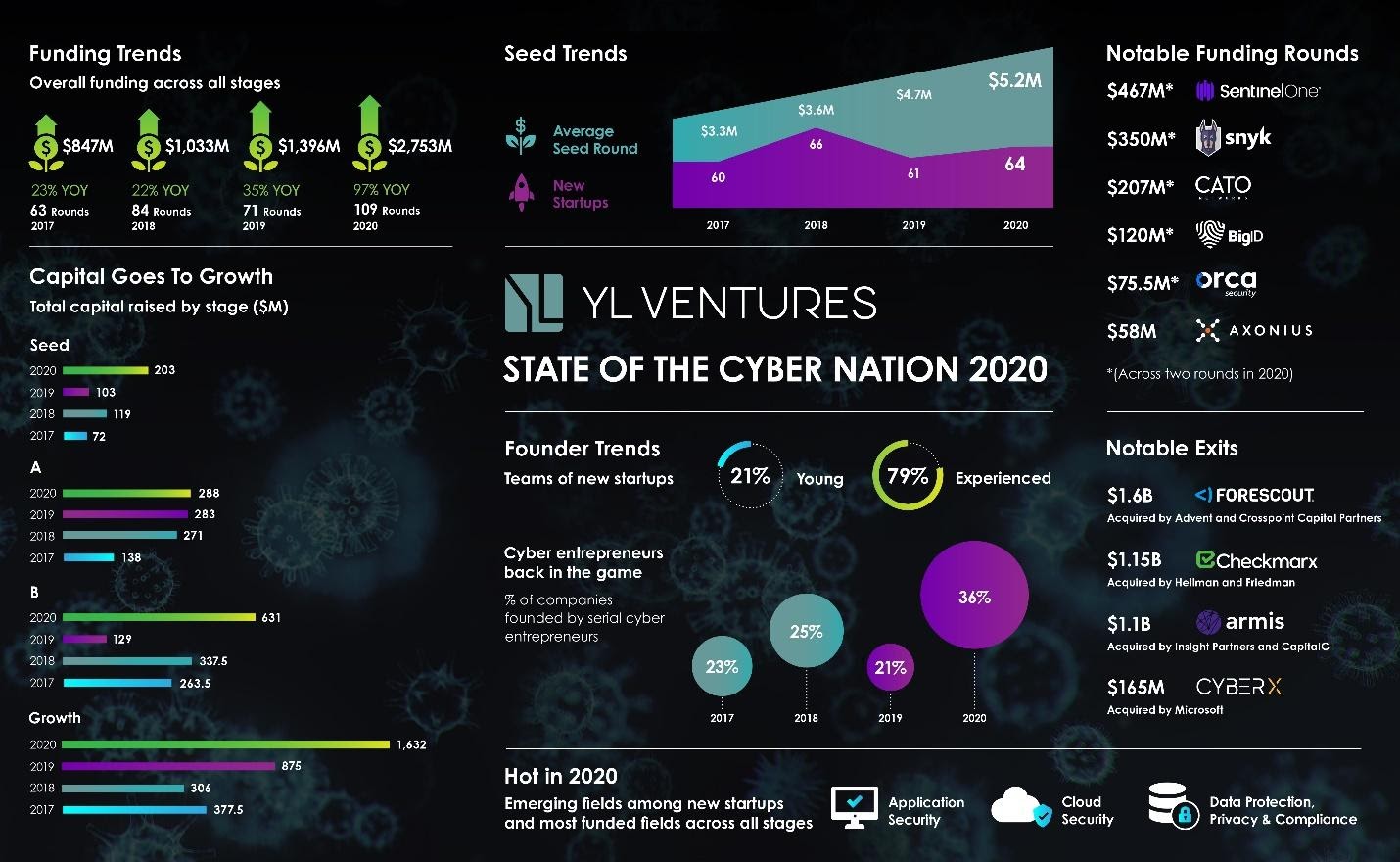

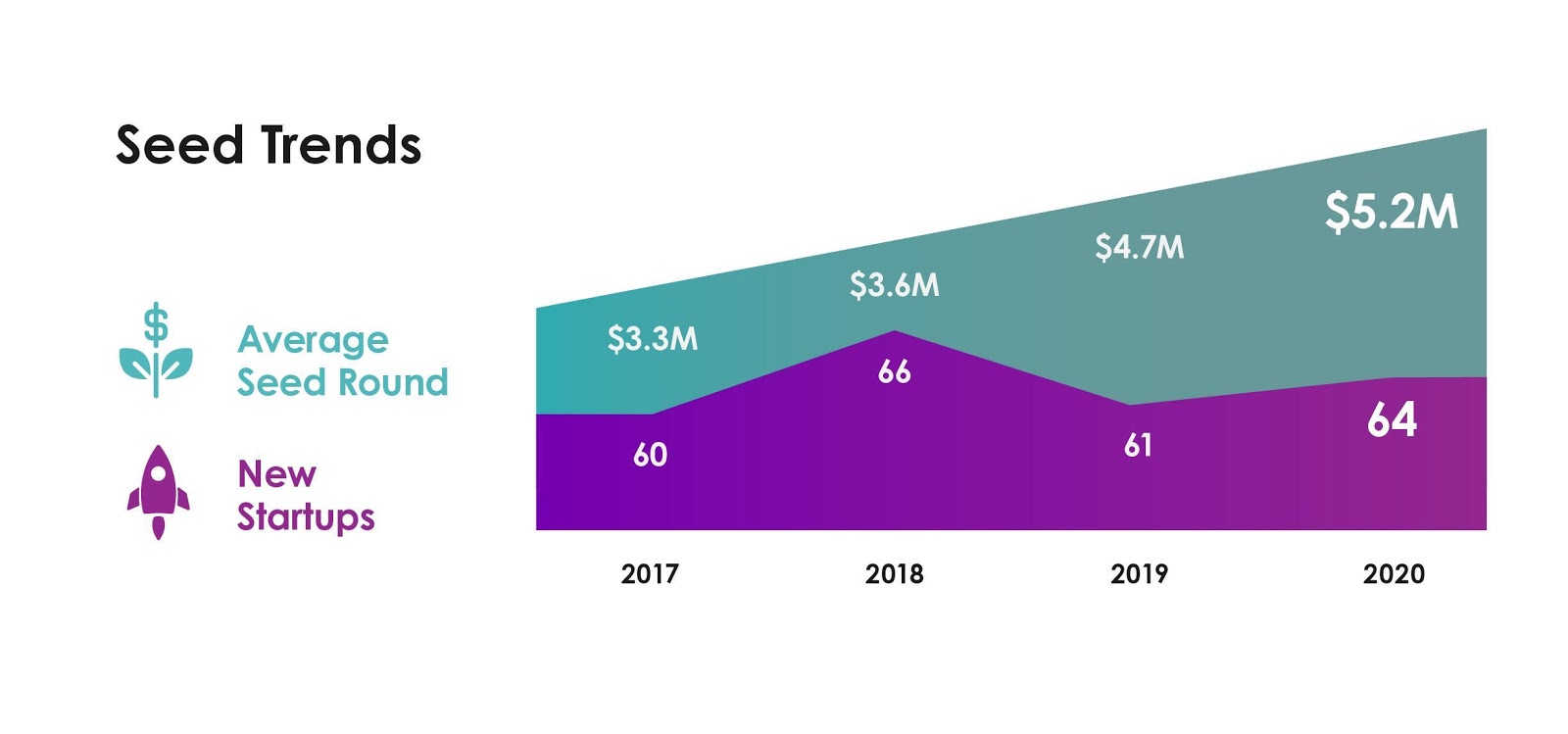

2020 was a record year for Israel’s security startup ecosystem — A look back at notable funding trends, rounds and exits.

Five questions about 2021’s startup market — Each question relates to a 2020 change that is expected to persist.

(Extra Crunch is our membership program, which aims to democratize information about startups. You can sign up here.)

Everything else

Astronaut Anne McClain on designing and piloting the next generation of spacecraft — McClain is one of the astronauts who will be taking part in the Artemis missions.

Mixtape podcast: Behind the curtain of diversity theater — Most TechCrunch readers have probably heard of diversity reports, but you may not know what’s going on behind the scenes.

Original Content podcast: ‘Wonder Woman 1984’ might be a beautiful mess, or maybe just a mess — And yet one of my co-hosts actually preferred the sequel to the original.

The Daily Crunch is TechCrunch’s roundup of our biggest and most important stories. If you’d like to get this delivered to your inbox every day at around 3pm Pacific, you can subscribe here.